-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

China (Taiwan)

China (Taiwan) -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

Exploring Efficient Methods for Streamlining FRP Laundering

Streamlining FRP Laundering Efficient Methods Explored

The laundering of financial resources linked to fraudulent activities has become an increasing concern in today's interconnected world. This phenomenon, commonly known as financial fraud and money laundering, poses significant risks to economies and financial systems globally. In this context, the need for efficient methods to streamline the laundering process of Financial Resource Planning (FRP) becomes paramount for both organizations and regulatory bodies to effectively combat these threats.

One promising approach for streamlining FRP laundering investigations involves the integration of advanced data analytics and machine learning techniques. By leveraging these technologies, organizations can analyze vast amounts of financial data in real-time, allowing for the identification of patterns commonly associated with fraudulent behavior. Machine learning algorithms can be trained to recognize anomalies in transaction flows, flagging suspicious activities that may warrant further investigation. This not only accelerates the detection process but also enhances the accuracy of identifying potential fraudulent operations.

Moreover, implementing a robust framework for data sharing among financial institutions can significantly improve the efficiency of detecting and preventing FRP laundering. Establishing secure protocols for sharing information about suspicious transactions and known fraudsters creates a collaborative ecosystem where institutions can pool their resources and intelligence. This collective effort enhances overall situational awareness and allows for timely intervention before illicit activities escalate.

exploring efficient methods for streamlining frp laundering

In addition, automating routine compliance checks and reporting processes can save valuable time and resources. Instead of relying solely on manual reviews, organizations can employ software solutions that automate the monitoring of transactions and compliance with regulations. This reduces the burden on compliance teams, enabling them to focus on more complex cases that require human expertise and judgment.

Another vital aspect of streamlining FRP laundering is the continuous training and education of personnel involved in compliance and fraud detection. Regular workshops and training sessions designed to keep staff updated on the latest fraud schemes and investigative techniques will empower them to identify potential risks more effectively. A well-informed team is instrumental in creating a proactive approach to preventing financial crimes.

Finally, fostering a culture of transparency and accountability within organizations plays a crucial role in streamlining FRP laundering processes. Encouraging employees to report suspicious activities and ensuring they understand the importance of addressing potential fraud will contribute to a more vigilant workplace. By cultivating this mindset, organizations can bolster their defenses against financial crimes and promote ethical practices.

In conclusion, while the challenges associated with FRP laundering are significant, employing advanced data analytics, enhancing cooperation among institutions, automating compliance processes, providing continuous training, and fostering transparency can greatly streamline efforts against financial fraud. As we move forward, these efficient methods will be essential in safeguarding financial integrity and maintaining trust in economic systems worldwide.

Latest news

-

Exploring the Benefits of Top Hammer Drifter Rods for Enhanced Drilling PerformanceNewsJun.10,2025

-

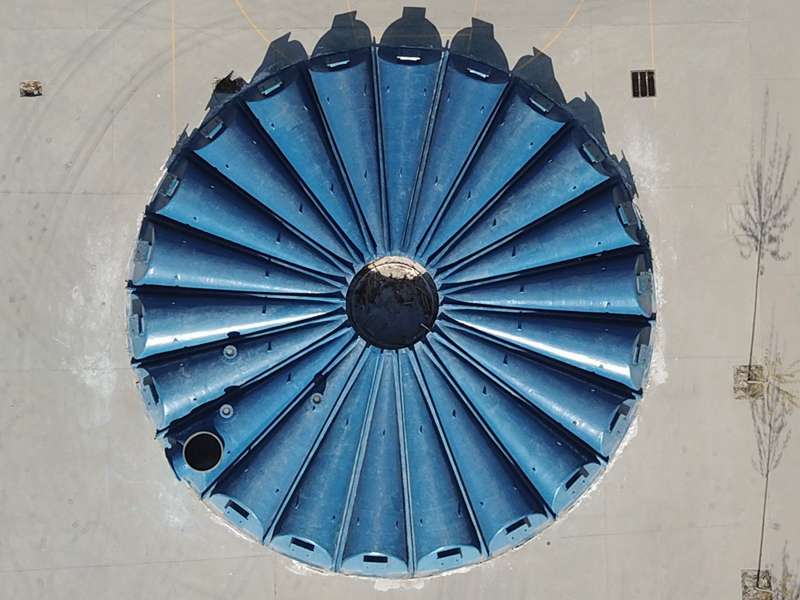

High-Precision Fiberglass Winding Machine for GRP/FRP Pipe Production – Reliable & Efficient SolutionsNewsJun.10,2025

-

FRP Pipes & Fittings for Shipbuilding - Corrosion-Resistant & LightweightNewsJun.09,2025

-

Premium FRP Flooring Solutions Durable & Slip-ResistantNewsJun.09,2025

-

Premium Fiberglass Rectangular Tanks Durable & Lightweight SolutionNewsJun.09,2025

-

Tapered Drill String Design Guide Durable Performance & UsesNewsJun.09,2025