-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

China (Taiwan)

China (Taiwan) -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

exploring efficient methods for streamlining frp laundering

Exploring Efficient Methods for Streamlining FRP Laundering

The financial landscape has seen remarkable evolution over the past few decades, with the rise of various illicit activities posing significant challenges to regulatory frameworks across the globe. One particularly concerning trend is the laundering of funds derived from fraudulent activities, which has increasingly involved the use of Financial Resource Providers (FRPs). As criminal networks become more sophisticated, it is imperative for financial institutions, regulatory bodies, and law enforcement agencies to explore efficient methods for streamlining the laundering prevention processes associated with FRPs.

Firstly, understanding the nature of FRPs is critical. These entities can range from small, independent operators to large financial institutions, all of which may inadvertently become conduits for laundering illicit funds. The traditional methods of monitoring and auditing these providers have been reactive in nature, often coming into play only after fraud has been detected. This approach is not only inefficient but also insufficient in a rapidly evolving digital economy where transactions occur in real-time and across borders.

To enhance the effectiveness of fraud prevention measures, a proactive, risk-based approach is essential. This involves implementing robust Know Your Customer (KYC) practices that extend beyond basic identity verification. Enhanced due diligence should be a standard practice, with financial institutions being encouraged to invest in advanced analytics tools that can assess the risk profiles of their clients. Machine learning algorithms can play a pivotal role here, as they can analyze vast amounts of transaction data to identify patterns indicative of laundering activities, flagging suspicious transactions before they occur.

Moreover, collaborative approaches among stakeholders can significantly enhance the efficiency of laundering prevention efforts. Establishing partnerships between financial institutions, law enforcement agencies, and regulatory bodies can facilitate the sharing of information and best practices. Such collaboration could potentially lead to the creation of a centralized database that logs suspicious activities, which would allow for quicker analysis and response mechanisms. By breaking down silos and fostering a culture of transparency, stakeholders can collectively mitigate the risks associated with FRPs.

exploring efficient methods for streamlining frp laundering

Technology is another powerful ally in the fight against money laundering. The adoption of blockchain technology has the potential to revolutionize the way transactions are conducted and monitored. Distributed ledger systems provide an immutable record of transactions, allowing for real-time tracking and verification of financial activities. This can greatly reduce the opacity that often shrouds traditional banking systems, making it more challenging for criminal enterprises to operate undetected.

Additionally, financial institutions must not only rely on technology but also invest in continuous staff training and awareness programs. The human element in fraud detection and prevention remains critical. Employees who are well-versed in the latest fraudulent schemes and laundering techniques are better equipped to spot irregularities and act proactively. Regular training sessions, workshops, and information-sharing forums can cultivate a knowledgeable workforce that serves as the first line of defense against financial crimes.

Regulatory frameworks must also evolve to keep pace with these technological advancements and emerging threats. Policymakers should focus on creating agile regulations that can adapt to new methodologies employed by criminals. This could involve revising compliance guidelines to incorporate technology-driven processes and practices that encourage rapid identification and reporting of suspicious activities.

Finally, public awareness campaigns can play a crucial role in the broader effort to combat fraud and money laundering. Educating consumers about the potential risks associated with their financial transactions can promote vigilance and encourage reporting of suspicious behavior. As the general public becomes more informed, the collective capacity to detect and prevent laundering activities increases, creating an environment where illicit financial activities are less likely to thrive.

In conclusion, streamlining the laundering prevention processes related to FRPs is not only a challenge but an imperative in today’s financial ecosystem. By embracing a multifaceted approach that leverages technology, fosters collaboration, enhances staff capabilities, and promotes regulatory adaptability, stakeholders can work towards significant progress in preventing the laundering of funds. As the sophistication of fraud increases, so too must our efforts to combat it, ensuring that financial systems remain secure, transparent, and resilient against the threats posed by criminal enterprises.

Latest news

-

Exploring the Benefits of Top Hammer Drifter Rods for Enhanced Drilling PerformanceNewsJun.10,2025

-

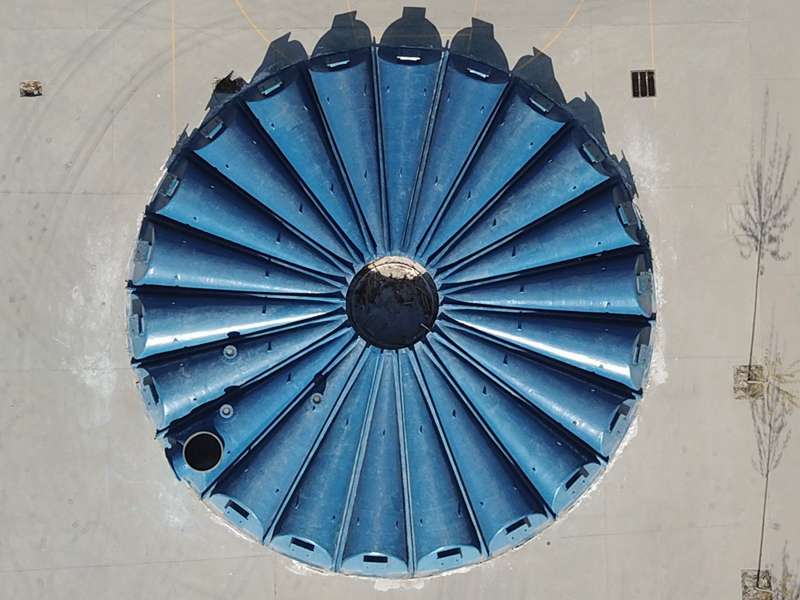

High-Precision Fiberglass Winding Machine for GRP/FRP Pipe Production – Reliable & Efficient SolutionsNewsJun.10,2025

-

FRP Pipes & Fittings for Shipbuilding - Corrosion-Resistant & LightweightNewsJun.09,2025

-

Premium FRP Flooring Solutions Durable & Slip-ResistantNewsJun.09,2025

-

Premium Fiberglass Rectangular Tanks Durable & Lightweight SolutionNewsJun.09,2025

-

Tapered Drill String Design Guide Durable Performance & UsesNewsJun.09,2025