-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

China (Taiwan)

China (Taiwan) -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

grp cover

Understanding GRP Cover in Insurance A Comprehensive Overview

In the world of insurance, understanding various policy types and their implications is crucial for both businesses and individuals. One term that often comes up is GRP cover, which stands for General Retail Property cover. This type of insurance is designed to protect retail businesses against losses arising from various risks. In this article, we will delve into what GRP cover entails, why it is essential, and how businesses can benefit from it.

What is GRP Cover?

General Retail Property cover is a specialized insurance policy tailored for retail businesses, offering protection for assets, liabilities, and potential losses. It generally encompasses various forms of coverage, including property damage, theft, liability for employee injury, and even interruptions in business operations due to unforeseen events. Essentially, GRP cover provides a safety net, ensuring that retailers can recover and continue operations despite encountering unexpected challenges.

Importance of GRP Cover

1. Protection Against Property Damage Retail spaces can be susceptible to a range of damages, from natural disasters like floods and earthquakes to vandalism and fire. GRP cover helps businesses recover the financial losses incurred due to property destruction or damage, allowing them to restore their operations promptly.

2. Liability Coverage Retailers face various liabilities, such as slips and falls by customers, which can lead to expensive lawsuits. GRP cover typically includes liability insurance, protecting businesses from legal claims and ensuring that they can manage costs associated with such incidents.

3. Theft and Burglary Protection Retail establishments are often targets for theft and burglary. Having GRP cover means that in the event of stolen inventory or equipment, businesses can receive compensation, minimizing the financial impact of such crimes.

grp cover

4. Business Interruption Insurance If a retail operation faces interruption due to an unexpected event, such as a fire, GRP cover can help mitigate losses by compensating for lost profits during the downtime. This coverage is vital for maintaining cash flow and ongoing business expenses.

Benefits of GRP Cover

- Peace of Mind With the right GRP cover in place, retailers can focus on running their businesses without constantly worrying about potential risks. Knowing that they are protected against losses allows them to invest in growth and innovation.

- Tailored Coverage GRP cover can be customized to fit the specific needs of a retail business. Insurers often work closely with retailers to assess their unique risks and provide appropriate coverage options.

- Enhanced Reputation Businesses with adequate insurance coverage often appear more credible and trustworthy to consumers. This can lead to increased customer loyalty and enhanced reputation in the market.

Conclusion

In the competitive realm of retail, having the right insurance coverage is integral to ensuring long-term success and sustainability. GRP cover provides comprehensive protection, addressing the various risks that retailers face daily. By investing in GRP cover, businesses not only secure their assets but also pave the way for a more stable and prosperous future. As the retail landscape continues to evolve, the importance of understanding and implementing such insurance policies cannot be overstated. Retailers are encouraged to assess their needs and consult with insurance professionals to ensure they have the appropriate coverage to thrive in an ever-changing environment.

Latest news

-

Exploring the Benefits of Top Hammer Drifter Rods for Enhanced Drilling PerformanceNewsJun.10,2025

-

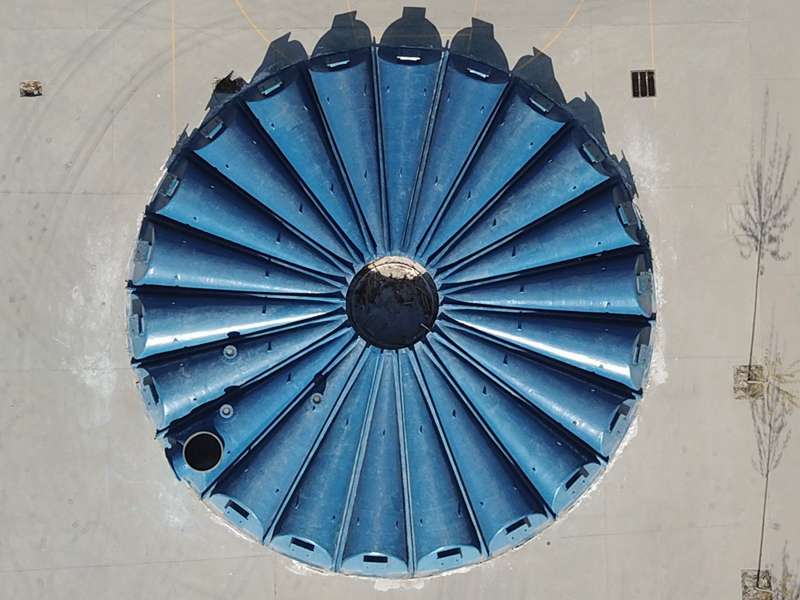

High-Precision Fiberglass Winding Machine for GRP/FRP Pipe Production – Reliable & Efficient SolutionsNewsJun.10,2025

-

FRP Pipes & Fittings for Shipbuilding - Corrosion-Resistant & LightweightNewsJun.09,2025

-

Premium FRP Flooring Solutions Durable & Slip-ResistantNewsJun.09,2025

-

Premium Fiberglass Rectangular Tanks Durable & Lightweight SolutionNewsJun.09,2025

-

Tapered Drill String Design Guide Durable Performance & UsesNewsJun.09,2025