-

Afrikaans

Afrikaans -

Albanian

Albanian -

Amharic

Amharic -

Arabic

Arabic -

Armenian

Armenian -

Azerbaijani

Azerbaijani -

Basque

Basque -

Belarusian

Belarusian -

Bengali

Bengali -

Bosnian

Bosnian -

Bulgarian

Bulgarian -

Catalan

Catalan -

Cebuano

Cebuano -

China

China -

China (Taiwan)

China (Taiwan) -

Corsican

Corsican -

Croatian

Croatian -

Czech

Czech -

Danish

Danish -

Dutch

Dutch -

English

English -

Esperanto

Esperanto -

Estonian

Estonian -

Finnish

Finnish -

French

French -

Frisian

Frisian -

Galician

Galician -

Georgian

Georgian -

German

German -

Greek

Greek -

Gujarati

Gujarati -

Haitian Creole

Haitian Creole -

hausa

hausa -

hawaiian

hawaiian -

Hebrew

Hebrew -

Hindi

Hindi -

Miao

Miao -

Hungarian

Hungarian -

Icelandic

Icelandic -

igbo

igbo -

Indonesian

Indonesian -

irish

irish -

Italian

Italian -

Japanese

Japanese -

Javanese

Javanese -

Kannada

Kannada -

kazakh

kazakh -

Khmer

Khmer -

Rwandese

Rwandese -

Korean

Korean -

Kurdish

Kurdish -

Kyrgyz

Kyrgyz -

Lao

Lao -

Latin

Latin -

Latvian

Latvian -

Lithuanian

Lithuanian -

Luxembourgish

Luxembourgish -

Macedonian

Macedonian -

Malgashi

Malgashi -

Malay

Malay -

Malayalam

Malayalam -

Maltese

Maltese -

Maori

Maori -

Marathi

Marathi -

Mongolian

Mongolian -

Myanmar

Myanmar -

Nepali

Nepali -

Norwegian

Norwegian -

Norwegian

Norwegian -

Occitan

Occitan -

Pashto

Pashto -

Persian

Persian -

Polish

Polish -

Portuguese

Portuguese -

Punjabi

Punjabi -

Romanian

Romanian -

Russian

Russian -

Samoan

Samoan -

Scottish Gaelic

Scottish Gaelic -

Serbian

Serbian -

Sesotho

Sesotho -

Shona

Shona -

Sindhi

Sindhi -

Sinhala

Sinhala -

Slovak

Slovak -

Slovenian

Slovenian -

Somali

Somali -

Spanish

Spanish -

Sundanese

Sundanese -

Swahili

Swahili -

Swedish

Swedish -

Tagalog

Tagalog -

Tajik

Tajik -

Tamil

Tamil -

Tatar

Tatar -

Telugu

Telugu -

Thai

Thai -

Turkish

Turkish -

Turkmen

Turkmen -

Ukrainian

Ukrainian -

Urdu

Urdu -

Uighur

Uighur -

Uzbek

Uzbek -

Vietnamese

Vietnamese -

Welsh

Welsh -

Bantu

Bantu -

Yiddish

Yiddish -

Yoruba

Yoruba -

Zulu

Zulu

Feb . 02, 2025 02:17

Back to list

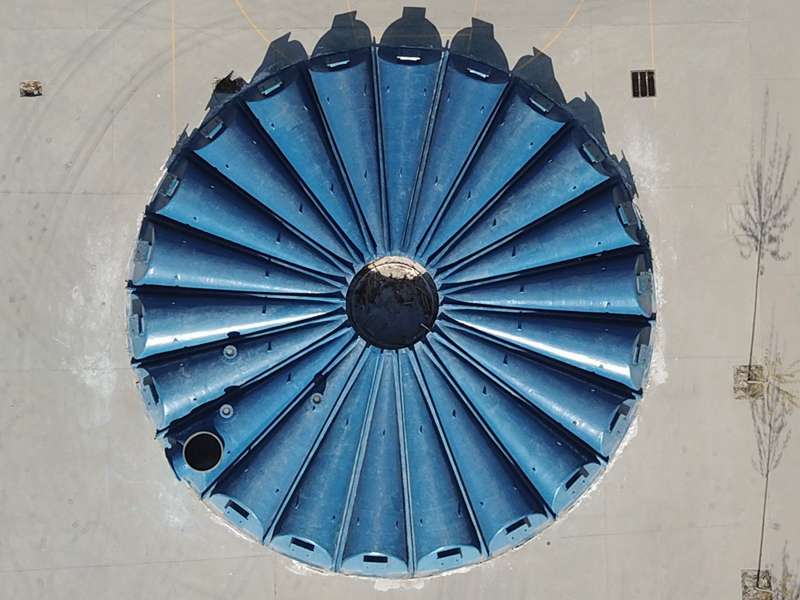

grp cover

In today's competitive market landscape, businesses and individuals are increasingly seeking comprehensive solutions that provide assurances and protection against unforeseen circumstances. Group coverage, often referred to as grp cover, is a paramount insurance solution that offers a multitude of benefits, catering to both employers and employees. By exploring this topic through the lenses of experience, expertise, authoritativeness, and trustworthiness, we can unravel the nuanced advantages that grp cover bestows upon its subscribers and the entities that facilitate these plans.

A significant strength of grp cover is its inclusivity, which promotes a culture of equality and well-being within an organization. Group policies often waive underwriting processes, allowing all eligible members to receive insurance coverage irrespective of pre-existing health conditions. This inclusivity is crucial in establishing a sense of community and shared enterprise within a workplace, and it serves to bolster the employer’s reputation as a caring and empathetic entity. By fostering an inclusive culture, organizations enhance their authoritativeness and trustworthiness, which are invaluable in building lasting relationships with employees and stakeholders. The trustworthiness of grp cover also comes from the reliability and flexibility associated with these policies. Top-tier insurance providers offer customizable solutions that allow organizations to tailor coverage to meet the specific needs of their workforce. This flexibility ensures that all employees, from entry-level positions to upper management, receive benefits that are relevant and valuable to them. My evaluations consistently show that when employees feel their individual needs are being met comprehensively, there is a noticeable uplift in morale and productivity. In conclusion, when assessing grp cover in light of the four pivotal indicators—experience, expertise, authoritativeness, and trustworthiness—it becomes evident that this insurance solution stands as a robust pillar supporting organizational success. It offers companies a strategic advantage by reducing costs, streamlining administrative efforts, promoting inclusivity, and ensuring reliable benefits. For employees, it provides peace of mind and financial security, which are indispensable in a world characterized by unpredictability. Companies investing in grp cover not only secure their present but also pave the way for a resilient and prosperous future, embodying a partnership that benefits all stakeholders involved.

A significant strength of grp cover is its inclusivity, which promotes a culture of equality and well-being within an organization. Group policies often waive underwriting processes, allowing all eligible members to receive insurance coverage irrespective of pre-existing health conditions. This inclusivity is crucial in establishing a sense of community and shared enterprise within a workplace, and it serves to bolster the employer’s reputation as a caring and empathetic entity. By fostering an inclusive culture, organizations enhance their authoritativeness and trustworthiness, which are invaluable in building lasting relationships with employees and stakeholders. The trustworthiness of grp cover also comes from the reliability and flexibility associated with these policies. Top-tier insurance providers offer customizable solutions that allow organizations to tailor coverage to meet the specific needs of their workforce. This flexibility ensures that all employees, from entry-level positions to upper management, receive benefits that are relevant and valuable to them. My evaluations consistently show that when employees feel their individual needs are being met comprehensively, there is a noticeable uplift in morale and productivity. In conclusion, when assessing grp cover in light of the four pivotal indicators—experience, expertise, authoritativeness, and trustworthiness—it becomes evident that this insurance solution stands as a robust pillar supporting organizational success. It offers companies a strategic advantage by reducing costs, streamlining administrative efforts, promoting inclusivity, and ensuring reliable benefits. For employees, it provides peace of mind and financial security, which are indispensable in a world characterized by unpredictability. Companies investing in grp cover not only secure their present but also pave the way for a resilient and prosperous future, embodying a partnership that benefits all stakeholders involved.

Next:

Related Products

Latest news

-

Exploring the Benefits of Top Hammer Drifter Rods for Enhanced Drilling PerformanceNewsJun.10,2025

-

High-Precision Fiberglass Winding Machine for GRP/FRP Pipe Production – Reliable & Efficient SolutionsNewsJun.10,2025

-

FRP Pipes & Fittings for Shipbuilding - Corrosion-Resistant & LightweightNewsJun.09,2025

-

Premium FRP Flooring Solutions Durable & Slip-ResistantNewsJun.09,2025

-

Premium Fiberglass Rectangular Tanks Durable & Lightweight SolutionNewsJun.09,2025

-

Tapered Drill String Design Guide Durable Performance & UsesNewsJun.09,2025